utah solar energy tax credit

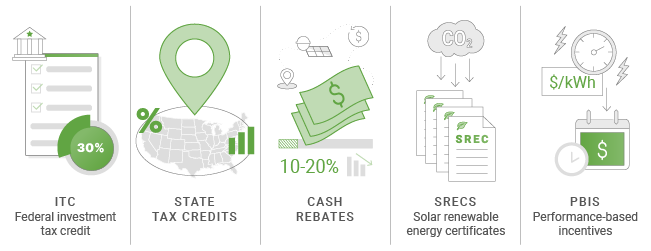

Systems installed on or before December 31 2019 were also eligible for a 30 tax credit It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034. Attach TC-40A to your Utah return.

Utah Solar Incentives 2022 Cost And Savings Saveonenergy

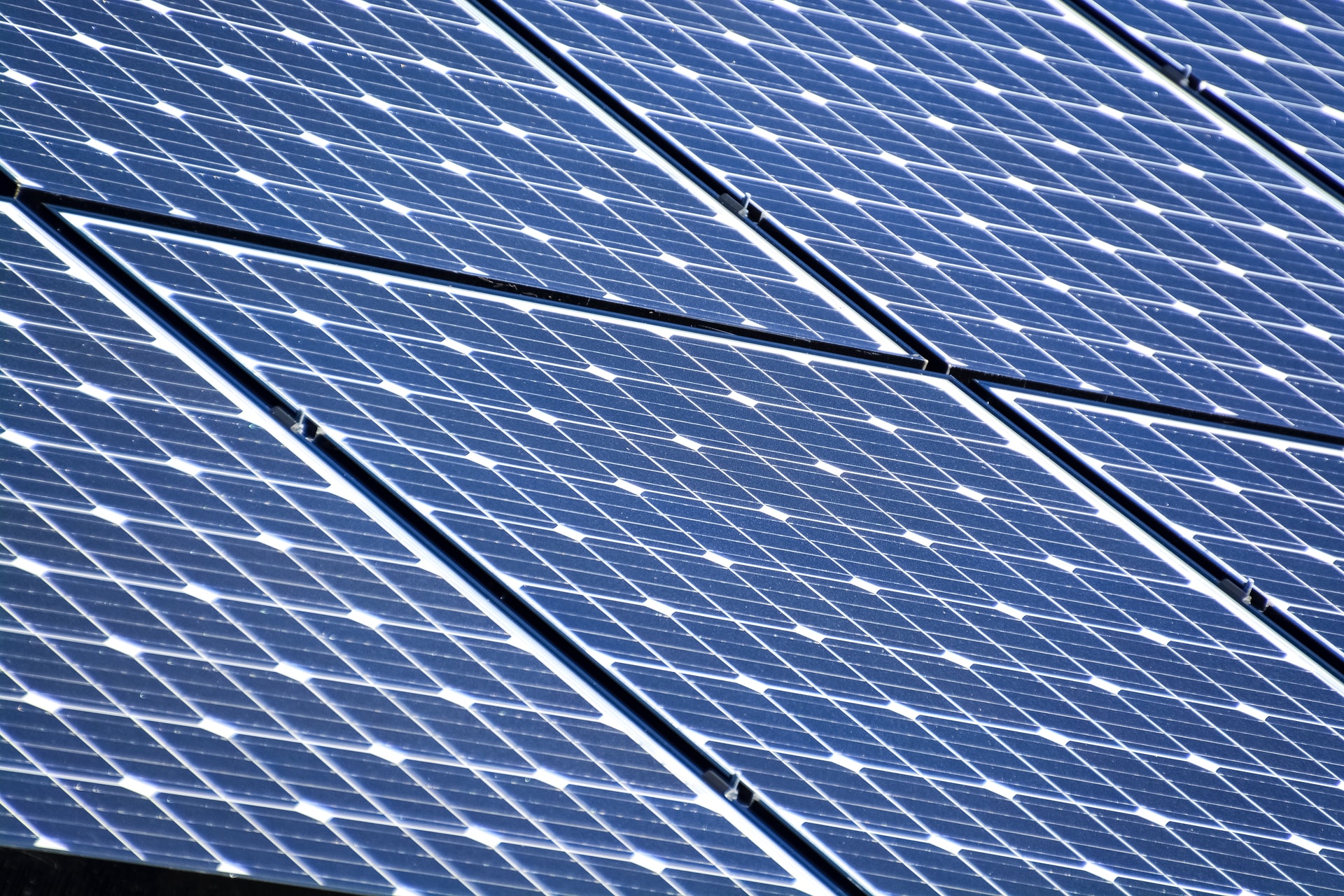

The state of Utah also offers potential ways for homeowners to save.

. Residential tax credits span rooftop solar as well as installations utilizing solar thermal wind geothermal hydro and biomass technologies. That will decrease to 26 for systems installed in 2033 and to 22 for systems installed. The Production Tax Credit is available for large scale solar PV wind biomass and geothermal electricity generating renewable energy projects over 660 kilowatts nameplate capacity system.

Utah Renewable Energy Systems Tax Credit Corporate is a State Financial Incentive program for the State market. Utah State Energy Tax Credits Utah offers state solar tax credits -- 25 of the purchase and installation costs of a solar system -- up to a maximum of 2000. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply.

Commercial Utah offers a suite of tax credits for. Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. Those who install a PV system between 2022 and 2032 will receive a 30 tax credit.

The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum. Additionally the state of Utah offers its own solar panel tax credit that allows you to claim up to 25 of your costs up to 1600. The credit is being.

The states renewable energy systems tax credit allows you to claim 25 of your solar panel purchase on. Everyone in Utah is eligible to take a personal tax credit when installing solar panels. The new Residential Clean Energy Credit allows homeowners and business owners to subtract 30 of the costs associated with installing solar energy from their federal taxes.

Utahs energy and innovation plan. Taking a thoughtful measured approach to energy policy keeps. Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes.

Plus solar owners can cash in on Utahs net. Find other Utah solar and renewable energy rebates and incentives on Clean. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings.

The Utah solar tax credit the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects. In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022-2032. Utahs solar tax credit makes going solar easy.

The Utah Office of Energy Development administers the tax. As a credit you take the. Affordability reliability and sustainability are Utahs priorities for all its energy-related work.

Utahs income tax credit for renewable energy systems includes provisions for both residential and commercial applications.

Senate Passes Solar Friendly Inflation Reduction Act Solar Industry

Inflation Reduction Act Poised To Bring Millions To Utah Energy Transition

After 10 Years This Utah Alternative Energy Tax Credit Has Yet To Pay Out Any Money

Are Solar Panels Worth It 2022 Guide

Solar Energy Company In Intermountain Wind Solar

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Congress Passes 30 Energy Tax Credit Harness The Power Of The Sun With Hedgehog Electric Solar St George News

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

Solar Power In Indiana Wikipedia

Utah Solar Tax Guide Everlight Solar

Is Solar Worth It In Utah Energy Report

Solar Rebates And Incentives Energysage

How Does The Utah Solar Tax Credit Work Iws

Tc 40e Fill Out Sign Online Dochub

Utah Solar Incentives Creative Energies Solar