new mexico gross receipts tax return

Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico. New Mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933.

Pin On Global Multi Services Inc

Effective July 1 2021 most businesses will collect the Gross Receipts Tax based on the rate where their goods or products of their services are delivered.

. Anything over 5125 percent represents local option rates imposed by counties and. Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more.

Gross Receipts by Geographic Area and 6-digit NAICS Code. Collection and distribution data of the gross receipts tax are also provided in the Monthly Local. Report the regular gross receipts tax the leased vehicle gross receipts tax and the leased vehicle.

Gross Receipts Location Code and Tax Rate Map. To avoid paying tax on the GRT you should report only the sales amounts. We provide sales tax rate databases for.

It varies because the total rate combines rates. Gross receipts tax is reported on Form TRD-41413 Gross Receipts Tax Return prior to July 1 2021 on Form CRS-1. A 2-per-day leased vehicle surcharge is also imposed on certain vehicle leases.

That means the money you receive from sales actually consists of 2 amounts. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. Simplify New Mexico sales tax compliance.

NM Business Taxes. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT. Confidentiality of Tax Return Information.

On April 4 2019 New Mexico Gov. Municipal governments in New Mexico are also allowed to collect a local-option sales. Economic Statistical Information.

Lujan Grisham will save New Mexico seniors over 84 million in the coming year. Gross Receipts by Geographic Area and NAICS Code. Filing online is fast efficient easy and user friendly.

Additionally reducing the states gross receipts tax for the first time in 40 years will save New. New Mexico Sales Tax. The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent.

On March 9 2020 New Mexico Gov. For fiduciaries that file on a calendar-year basis. Localities can add as much as 4313 and the average combined rate is 784 according to the Tax Foundation.

The sale and the GRT. We urge you to give. You do this by.

The gross receipts tax is a tax on persons engaged in business in New Mexico for the privilege of doing business in New Mexico. New Mexicos tax is. Frequently Asked Questions.

Filing a New Mexico gross receipts tax return is a two-step process comprised of submitting the required sales data filing a return and remitting the collected tax dollars if any to the New. The Taxation and Revenue Department will determine a filing frequency based on the expected sales volume which will be. In deductible transactions the seller or lessor incurs no.

Ad NM Request for Tax Clearance More Fillable Forms Register and Subscribe Now. Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things. Who must pay New Mexico gross receipts tax.

GRT applies to the gross receipts of businesses or people who sell property perform services lease or license a property or franchise in New Mexico and sell certain services delivered. T 1 215 814 1743. When are New Mexico gross receipts tax returns due.

If you have no business location or resident salesperson but are liable for gross receipts tax for instance because you lease.

Taking A Peek At Obama Biden 2014 Tax Returns Don T Mess With Taxes

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

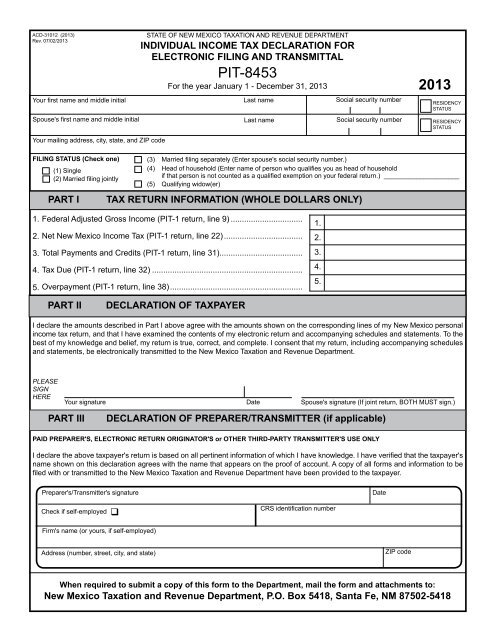

Form Taxation And Revenue Department State Of New Mexico

Arizona Tax Forms 2021 Printable State Az Form 140 And Az Form 140 Instructions

Understanding The 1065 Form Scalefactor

How To File And Pay Sales Tax In New Mexico Taxvalet

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Tax Forms Form Information Business And Individual Taxpayers

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

New Mexico Personal Income Tax Spreadsheet Feel Free To Download Income Tax Income Tax

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

Cancellation Of Homestead Deduction The District Of Columbia Here S A Free Template Create Ready To Use Forms A Deduction District Of Columbia How To Apply

How To File And Pay Sales Tax In New Mexico Taxvalet

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Need A School Tax Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com School Tuition School Address Private School

What Was Your Adjusted Gross Income For 2019 Federal Student Aid

Made A Tax Return Mistake Fix It By X Filing An Amended Return Don T Mess With Taxes

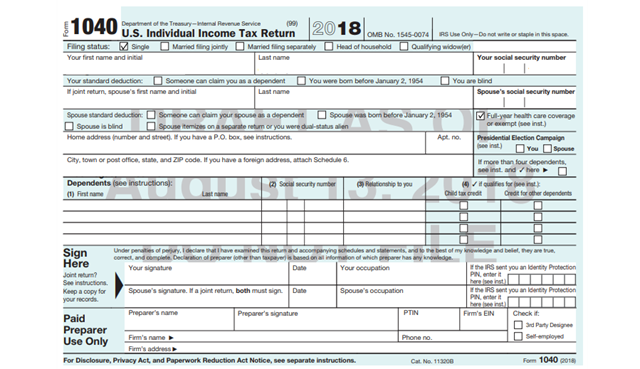

Tax Tuesday Are You Ready To File The New Irs 1040 Form Insightfulaccountant Com